8. August 2019 | Forms of Employment

Marginal part-time employment in Germany: live or let die?

Mini-jobs are one of the employment forms in Germany that have repeatedly led to fierce controversy in the past one and a half decades. The dispute was triggered by the reform of marginal part-time employment in the “First Law for Modern Services on the Labour Market” (“Hartz I”) in the year 2003. In the law the so-called mini-jobs were established and midi-jobs were introduced with a sliding pay and contribution scale as a transition into employment covered fully by social security.

As was already the case before 1999, this law once again made it irrelevant for income tax and social security whether a mini-job is a person’s main job or a second one. Since then, all types of mini-jobs have been tax-free for the employees, although the employers pay flat rates for insurances and taxes. Furthermore, the reform raised the monthly wage threshold from its previous level of 325 euros to 400 euros. The restriction of weekly working hours to 15, which had been in place until then, was dropped without replacement.

The pros and cons of marginal part-time employment

In the debate surrounding mini-jobs serious arguments are put forward by both sides. Factors in favour of this employment form are that it enables workers to earn additional income in an unbureaucratic way and that it may facilitate access to the labour market. Moreover, mini-jobs can increase firms’ flexibility with regard to staff deployment as well as potentially countering the spread of undeclared employment.

However, these advantages came at a price, especially for the people holding mini-jobs. For example, desired transitions into employment covered by social security are made more difficult due to tax-free thresholds. Regulations pertaining to employment law are not always implemented. People who hold marginal part-time jobs for longer periods accrue low pension rights. The regulations on mini-jobs can have negative effects for firms, too. If it is not really worthwhile for employees to do extra work, skilled labour potential is lost.

Suggestions regarding a new reform of mini-jobs range from further increases in the monthly wage threshold to complete elimination of the existing advantages with regard to taxes and social security contributions. The research findings that are relevant for possible amendments to the regulations are summarized in the following and various reform options are discussed.

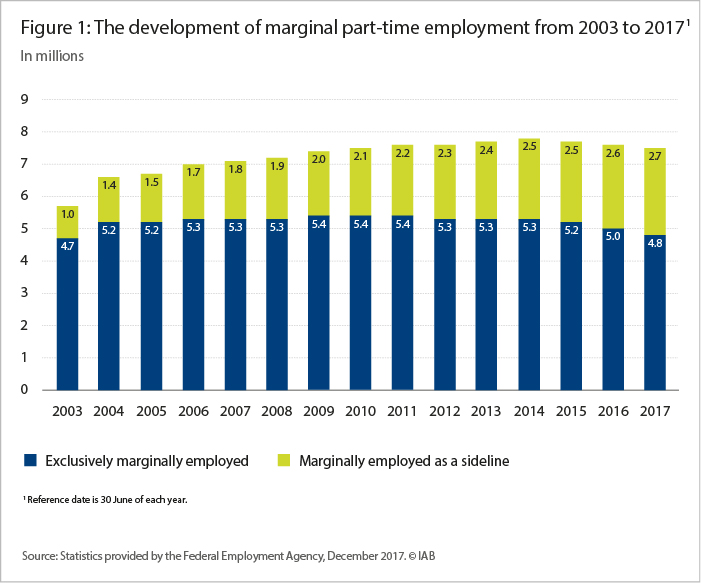

The number of mini-jobs as a second job almost trebled since 2003

The number of mini-jobs increased overall from 5.7 to 7.8 million between 2003 and 2014, before decreasing slightly to 7.5 million by 2017 (see Figure 1). The two main groups of mini-job holders developed differently in this period. After the law was changed in 2003, the number of people working only in marginal part-time employment (with a mini-job as their only job) increased rapidly by 500,000 to 5.2 million in 2004, but rose only slightly further to 5.4 million in the following years. Since 2011 the figure has declined steadily, to 4.8 million most recently. In contrast, the number of people with a mini-job as a second job has grown continuously, almost trebling since reaching one million in 2003.

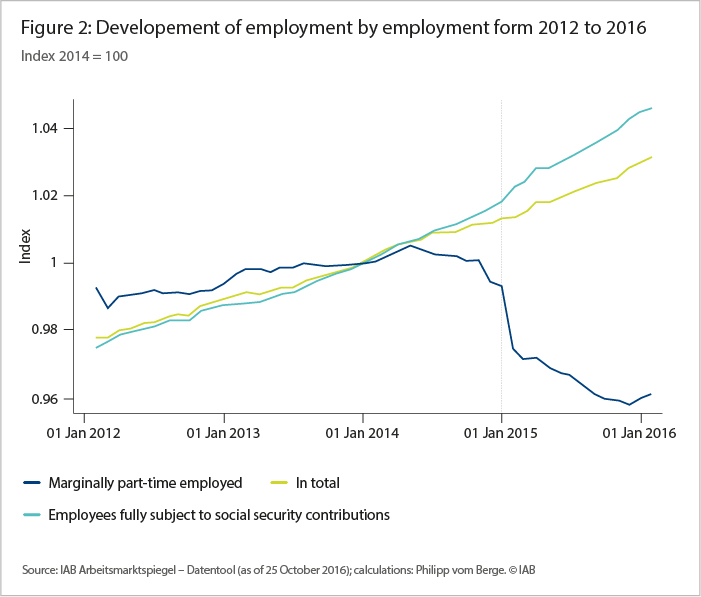

Research findings suggest that the number of exclusive mini-jobs fell markedly when the statutory minimum wage was introduced. However, according to descriptive findings, the loss of marginal part-time employment was probably partly offset by a considerable level of mini-jobs being converted into jobs subject to social security contributions (see Figure 2). A problem that is becoming increasingly evident is that, with the given monthly wage threshold of mini-jobs, every rise in the hourly minimum wage has to lead to a reduction of working hours for people with such jobs.

Sociodemographic composition and sectoral structure of mini-job employment

Compared to workers in employment covered by social security, women, older and low-skilled workers are over-represented in the group with a marginal part-time job as their main job. According to their own statements a good 40 percent of those holding mini-jobs are housewives (or to a very low extent househusbands), somewhat more than 20 percent are school pupils or students, another good 20 percent are retired, and just over 10 percent are unemployed. A disproportionately high number of mini-jobs are found in the services sector, especially in hotels and restaurants and in the retail trade.

Analyses reveal that a change in the sociodemographic composition of the workforce, for example a higher labour-force participation of women, and shifts in the sectoral structure of employment, for instance in favour of services, have not had any notable impact on the development of marginal part-time employment as shown by the author’s 2014 study. In fact, changes in the behaviour of firms and individuals, partly in response to altered institutional basic conditions, were more decisive. One possible reason for this could be that in Germany mini-jobs have for some time benefited in many ways from being subject to lower taxes and social security contributions, which makes this employment form equally attractive for many employers and employees.

Firms’ motives for using mini-jobs

For using mini-jobs, employers currently pay flat-rate health insurance contributions, amounting to 13 percent of the gross wage, and flat-rate contributions to pension insurance amounting to 15 percent. In addition, a flat-rate tax of 2 percent is incurred. Totalling 30 percent, the employer contributions are higher than those paid for employment fully subject to social security contributions (just under 20 percent), yet the overall burden is lower than for other employment covered by social security, as no employee contributions to social security have to be paid and the worker is exempt from tax. Being exempt from tax and insurance contributions and thus having a better net wage, people with mini-jobs are more likely to make concessions with regard to their gross wages than workers in regular employment.

Findings from establishment surveys show first of all that the extent to which mini-jobs are used differs not only between industries – as mentioned above – but also depending on the size of the establishment. The smaller the establishment is, the more frequently it will make use of mini-jobs on average. While firms report in approximately half of the cases that they were above all taking their employees’ wishes into account when using part time employment, the reasons given for using mini-jobs are primarily the associated possibilities to deploy staff flexibly and according to often only temporary demand.

Studies looking into a possible displacement of employment subject to social security contributions by mini-jobs at firm level indicate that this may be the case to a certain extent in small establishments and in certain sectors, for example in the retail trade, in hotels and restaurants and in the health and social work sector. What remains unanswered is whether the substitution stems primarily from the firms’ needs or from those of the workers themselves, such as pupils, students or pensioners.

Workers’ motives for taking up mini-jobs

The fact that mini-jobs are exempt from taxes and social security contributions for the employees themselves makes such jobs attractive for many workers. This incentive is reinforced by the system of income splitting for married couples in tax law and so-called derivative rights for family members in pension and health insurance schemes, for example widows’ pensions.

The spread of mini-jobs is also encouraged by the opening hours of child-care facilities, which are still too short and too inflexible and often prevent mothers in particular from working as long as they would like to. Furthermore, especially low-wage workers weigh up very carefully whether it is worthwhile for them to work longer hours if this incurs additional costs due to having to leave their child in child-care longer.

Mini-jobber cite a number of reasons for having their job. Primarily they wish to earn at least some money and see their job as an opportunity to maintain contact to the labour market. Since the 1990s the share of people with mini-jobs who have no vocational qualifications has increased – presumably because especially the low-skilled nowadays are more reliant on (additional) mini-jobs. The specific household constellation also plays a role. For instance, particularly women who live in a household with a partner and children are more likely to have a mini-job today than in the past.

The fact that mini-jobber – irrespective of their sociodemographic characteristics – seek a new or an additional job more frequently than any other group of workers in dependent employment could be due to such workers being more likely to want to change their employment situation than those in regular employment. This is in line with findings from surveys, in which mini-jobber report that they would like to work more hours on average.

Bridging function of mini-jobs

Analyses of the transitions out of marginal part-time employment reveal a mixed picture. Contrary to what is suggested by the high search intensity, mini-jobs are only under specific conditions a bridge to regular employment. Recipients of basic income only manage the transition to a regular job if they did take up the mini-job several months after beginning benefit receipt. If, on the other hand, the mini-job was taken up during the first few months of benefit receipt, no bridging effect is found as a 2017 analysis by Torsten Lietzmann, Paul Schmelzer and Jürgen Wiemers shows. In contrast, other studies indicate that mini-jobs counteract a devaluation of existing vocational skills, increase the chances of remaining in the labour market and reduce the duration of unemployment.

Reasons for restricting mini-jobs

The available research findings do not advocate a radical reform of mini-jobs. A complete abolition would abruptly rob firms of a personnel-policy instrument. The workers affected would lose an attractive and flexible source of additional earnings – as well as the chance of a low-threshold entry to the labour market. However, the results do indeed favour reform steps in some areas. As long as a restriction of mini-jobs does not reduce total hours in the economy too severely, the state and the social security agencies – as can be shown by simulations – should expect increased revenues, which would then be available elsewhere in labour market and social policy.

Moreover, an increased probability of mini-jobs being converted into jobs subject to social security contributions should improve the chances of low-skilled workers finding more regular employment, providing many of them with a living wage. In addition, the incentives of secondary earners in the household context to work longer working hours can be increased by reforms. This would not only serve to secure skilled labour but in the longer term would also strengthen the old-age provision of the workers concerned. Institutional changes can aim to reduce the attractiveness of mini-jobs indirectly or to limit their scope directly. For both of these variants there are a number of alternative or complementary options.

Reform approach I: Strictly monitoring compliance with the minimum wage and other employment laws

A first starting point for restricting the scope of mini-jobs without infringing on the existing regulations is an effective minimum wage. Although since 2003 there has no longer been an explicit limit on working hours in mini-jobs, the statutory minimum wage meanwhile creates an implicit limit on hours. Taking the currently valid minimum wage of 9.19 euros (from 1.1.2019) per working hour and the monthly threshold of 450 euros as a basis, a person with a mini-job on a minimum wage would work a maximum of just under 49 hours per month or 11.3 hours per week. At the time when the minimum wage was introduced (8.50 euros per hour) the maximum possible working time was still a good 52 hours per month or 12.2 hours per week.

The minimum wage is effective if employers also adhere to the maximum working time in the mini-jobs. Consistent recording and effective monitoring of the working hours of workers in marginal part-time jobs can counteract activities in the shadow economy and irregularities in the organisation of working hours. Obligations to record working time and penalties for failing to do so could also encourage firms to comply with regulations that also apply to workers with mini-jobs, for example regarding continued payment of wages during sickness and holiday pay. Research findings suggest that there is room for improvement in this respect – not least due to a lack of information on the part of both firms and workers.

Reform approach II: Scaling back income splitting for married couples and derivative entitlement to social security

Another indirect restriction of mini-jobs could also be achieved by cutting advantages related to taxation and social security for couples when one partner only has a marginal part-time job. Possible options here are phasing out income splitting for married couples step by step, for example replacing it by a tax splitting scheme for families, or gradually reducing derivative rights in social security, for example widows’ pensions or contribution-free health insurance for spouses. Such steps would make employment covered by social security more attractive compared to mini-jobs.

Reform approach III: Expanding care services

Better and more comprehensive child-care facilities and services for family members in need of care would boost incentives to work longer hours. This covers aspects such as more all-day schools, affordable, high-quality care facilities and improved coverage of care services outside of peak times, for instance early in the mornings and evenings or on Saturdays. This would enable people with caring responsibilities to take up jobs with longer working hours. Expanding these services would therefore create more freedom of choice, which would probably lead to a reduction in the number of mini-jobs.

Reform approach IV: Extending in-work-benefits

Effective incentives to work longer hours could also be created by changing the rules on earning additional income while in receipt of unemployment benefit or basic security benefits for job seekers. Currently both systems allow benefit recipients to earn a very low income without deductions from benefit payments, which creates strong incentives for them to take up a mini-job with very few working hours. Income above this level is deducted from the benefit payment at exorbitant rates of between 80 and 100 percent.

If general exemption thresholds and allowances were used less in the lowest wage range and longer working hours were remunerated better, benefit recipients would be less interested in taking up mini-jobs. A 2018 study by Kerstin Bruckmeier et al. shows how this could be achieved by smoothing out the rate at which earned income is deducted from benefit payments and by expanding in-work benefits, such as housing benefit or supplementary child benefit for low-paid workers .

A possibly resulting more difficult access to the labour market for specific groups could be counteracted by means of targeted labour market policy measures, such as an increased use of training measures, temporary employment subsidies for employers and wage subsidies for employees.

Reform approach V: Limiting the privileged status of mini-jobs as second jobs

A direct option to limit the scope of mini-jobs by re-regulation would be to subject mini-jobs that are used as second jobs fully to taxation and social security contributions – as was already the case between 1999 and 2003. In this way existing differences in treatment would be eliminated. Whereas conventional overtime is generally fully subject to taxation and the payment of social security contributions, mini-jobs performed for a different employer as a second job are granted preferential treatment. By converting second jobs, it would be possible to create more opportunities for employment covered by social security for the low-skilled. A less comprehensive variant worth considering in this respect would be to extend the existing tax-free allowance of 2400 euros per year that is granted for certain forms of self-employment in the sense of a de minimis limit to cover all types of additional employment, thereby leaving a certain opportunity for additional earnings.

Reform approach VI: Lowering the wage threshold and extending the midi-job zone downwards

With respect to mini-jobs as a person’s exclusive job there would also be the possibility to lower the wage threshold again step by step. This would give everyone concerned time to adapt to the new regulation. The medium-term aim could be to bring the scope of marginal part-time employment and its preferential treatment into line with the rules applicable to short-term tax-free employment (“50-day rule”). If the statutory minimum wage is taken as a basis, this would be equivalent to about 300 euros per month. The additional tax revenues and social security contributions that could be expected from this could be used, for example, for the expansion of the midi-job zone to a range of 300.01 euros to 1300.00 euros. Although midi-jobs are subject to income tax, the employees concerned pay lower social security contributions.

Reform approach VII: Focussing mini-jobs with preferential terms on school pupils, students and pensioners

The broadest re-regulation would be to restrict the valid concessions regarding taxation and social security contributions for mini-jobs to school pupils, students and pensioners. This could be justified by the fact that for these groups of workers jobs covered by social security are generally not a desirable alternative. This major restriction would lead to additional tax revenues and social security contributions, which could be used in order to finance other reform suggestions such as more care services particularly addressing the work-life balance of parents.

Conclusion

Adjusting the regulations on mini-jobs and the basic conditions relevant for this employment form could help to secure skilled labour and open up alternative employment for the low-skilled that would pay them a living wage. Seven reform options were presented. There are, however, good reasons for not proceeding too hastily, and instead taking a step-by-step approach. One point in favour of gradual adjustments, for example, is that the necessary quantitative and qualitative expansion of child-care facilities and other care services as well as a modification of the tax and benefit system will take time. Taking steps with a sound judgement would also have the advantage that opportunities and risks of changes could be better sounded out in the context of scientific accompanying research, and individual regulations could be adjusted if necessary in the light of the insights gained.

References

Bruckmeier, Kerstin; Mühlhan, Jannek; Walwei, Ulrich; Wiemers, Jürgen (2018): Arbeit muss sich lohnen – auch im unteren Einkommensbereich! Ein Reformvorschlag. In: IAB-Forum, 21.12.2018, accessed on 17 June 2019.

Lietzmann, Torsten; Schmelzer, Paul; Wiemers, Jürgen (2017): Marginal employment for welfare recipients: stepping stone or obstacle? In: Labour, Vol. 31, No. 4, pp. 394-414.

Walwei, Ulrich (2014): Times of change: what drives the growth of work arrangements in Germany? In: Journal for Labour Market Research, Vol. 47, No. 3, pp. 183-204.

Walwei, Ulrich (2019): Marginal part-time employment in Germany: live or let die?, In: IAB-Forum 8th of August 2019, https://www.iab-forum.de/en/marginal-part-time-employment-in-germany-live-or-let-die/, Retrieved: 25th of April 2025

Diese Publikation ist unter folgender Creative-Commons-Lizenz veröffentlicht: Namensnennung – Weitergabe unter gleichen Bedingungen 4.0 International (CC BY-SA 4.0): https://creativecommons.org/licenses/by-sa/4.0/deed.de

Authors:

- Ulrich Walwei

Professor Ulrich Walwei is Vice Director of the IAB.

Professor Ulrich Walwei is Vice Director of the IAB.