Do tax incentives that reduce the cost of new machinery and equipment create economic growth? And how do such incentives affect employment?

An evaluation of the German investment tax credit programme (Investitionszulagengesetz), introduced in 1991 after reunification, offers useful insights. A 1999 policy change granted smaller firms in the East German manufacturing sector a greater increase in tax incentives than larger firms: On average, small firms received a 15.6 percent reduction on their investment cost while large firms received only an 8.0 percent reduction.

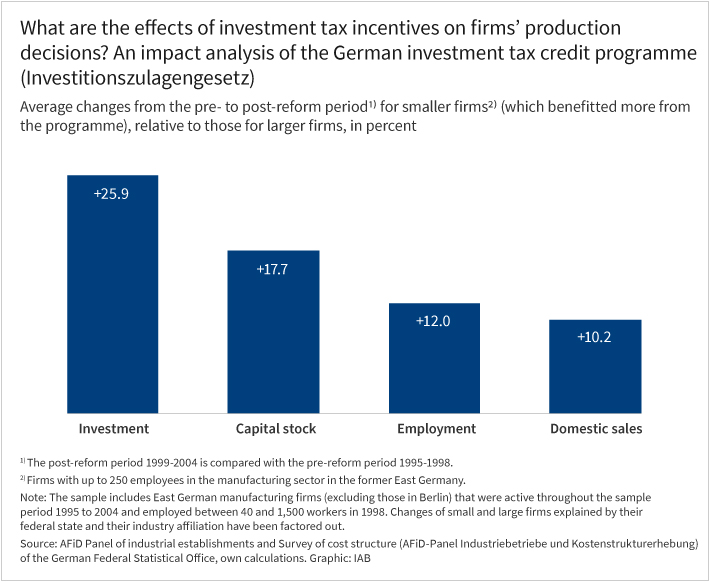

Following this change, smaller firms improved economically relative to larger ones. The figure shows that their investments rose by nearly 26 percent more than for larger firms, and their capital stock grew by almost 18 percent more.

These investment effects also translated into more jobs: smaller firms expanded their workforce by 12 percent relative to larger firms. Thus, the common concern that such incentives might encourage firms to replace workers with machines did not materialise. A likely reason is that the positive production effect on firms’ sales (see figure) created additional demand for workers, thereby counteracting any labour-reducing effects of new machinery.

In addition to these direct effects of reduced investment costs, the analysis reveals positive spillovers: through local production linkages, connected firms also expanded their production, thereby multiplying the local employment effect. At the same time, the analysis does not find any significant relocation of production from western to eastern German firms during this period.

Conclusion

Overall, the findings suggest that investment tax incentives gave a meaningful boost to the economy in the former East Germany – at least in the medium term. In light of today’s concerns about the weak economy in Germany, such incentives could again serve as a useful policy tool to stimulate growth and job creation.

References

Lerche, Adrian (2025): Direct and Indirect Effects of Investment Tax Incentives. American Economic Review,Vol. 115, No. 8, pp. 2781–2818.

picture: Arthon/stock.adobe.com

DOI: 10.48720/IAB.FOO.20251209.01

Lerche, Adrian (2025): Investment tax incentives can boost employment, In: IAB-Forum 9th of December 2025, https://iab-forum.de/en/investment-tax-incentives-can-boost-employment/, Retrieved: 9th of February 2026

Diese Publikation ist unter folgender Creative-Commons-Lizenz veröffentlicht: Namensnennung – Weitergabe unter gleichen Bedingungen 4.0 International (CC BY-SA 4.0): https://creativecommons.org/licenses/by-sa/4.0/deed.de

Authors:

- Adrian Lerche

Adrian Lerche is a senior researcher in the research department "Education, Training, and Employment Over the Life Course" at the IAB.

Adrian Lerche is a senior researcher in the research department "Education, Training, and Employment Over the Life Course" at the IAB.